Taxpayers who own various business entities often establish a management entity to provide management services to the entities and/or to act as a common paymaster and employer of all the various entities. The operating businesses will pay a fee to the management entity for the services provided, which fee will usually include an element for reimbursement of the hard costs of the management entity such as for employee wages and withholding taxes.

A recent Tax Court case challenged the deductions claimed by the operating entity for its payments to the management entity. The case addressed a number of the tax issues involved in these arrangements, and provides many “lessons” in structuring them. Some of the key lessons are described below.

1. WHEN WILL THE IRS ATTACK? The IRS will generally be interested in attacking these arrangements only when it perceives taxes are being deferred or avoided. Oftentimes, there are no deferral or avoidance circumstances. For instances, if the operating entities and the management entity are commonly owned, and are pass-through entities such as LLC’s, partnerships or S corporations, the deduction on the operations side is offset by the income on the management entity side. Even with C corporations, if both the operations side and the management side are profitable, then there is little chance of tax avoidance. In the instant case, the operating entity and the management entity were both S corporations. However, the management entity was owned by an ESOP. Thus, there was not common ownership on both sides. Further, the ESOP allowed for deferral or avoidance of tax on the management fees earned by the management entity, while the payor operating entity received an operating deduction. Thus, the IRS was very interested in challenging the management fees.

2. WILL THE MANAGEMENT ENTITY BE DISREGARDED AS A SHAM ENTITY? Relying on Moline Props., Inc. v. Commissioner, 319 U.S. 436 [30 AFTR 1291] (1943), in the instant case the IRS argued that the management entity should be disregarded for Federal income tax purposes because it lacked a legitimate business purpose and economic substance and was formed for the sole purpose of obtaining tax benefits. Such an attack can be successfully defended if the taxpayer can show the management entity was formed for a valid business purpose or if it actually engaged in business activity. Some business purposes that often exist in these circumstances (and that should be of assistance in defending a Moline-type attack) include:

a. Centralization of employee management;

b. Provision of management and other actual services;

c. Creditor protection (including products liability protection) by placing management in an entity without significant business assets and separating business activities in multiple entities;

d. Establishment of incentive and retirement plans for employees; and

e. Business efficiencies via centralization of services and activities.

In the instant case, while the taxpayer had difficulty factually proving a valid business purpose for the arrangement, it did conduct enough actual business activities to avoid a sham finding. In particular, the Tax Court noted that the management entity provided personnel services, maintained an investment and bank account, paid employees by check, adopted a retirement plan, followed corporate formalities and filed income and employment tax returns.

3. WILL MANAGEMENT FEES BE DEDUCTIBLE? Code §162 requires that expenses be ordinary and necessary in carrying on a trade or business to be deductible. Presumably, if the management entities provide employees to the operating entities, fees paid for such employees will be ordinary and necessary and deductible – this is what occurred in the subject case and was approved by the Tax Court. However, in the subject case, the IRS successfully challenged the management fees paid for other services. To enhance the deduction for such services, the following items are helpful:

a. Have an agreement to establish what services will be performed and what will be paid for them; and

b. Make sure the services are in fact performed by the management entity, and be able to specifically prove what was done (this was a problem in the subject case).

Overcharging or undercharging for fees can be problematic, either under Code §162 requirements of a “reasonable” amount, or Code §482 which requires amounts paid between commonly controlled entities to meet arms-length standards.

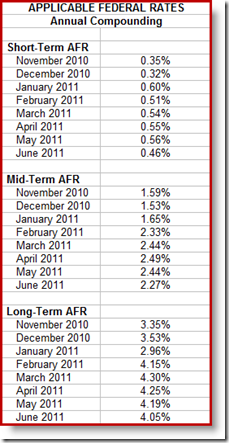

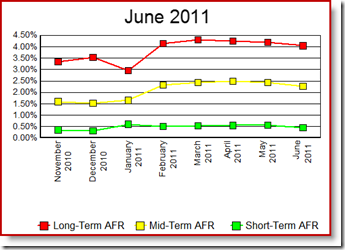

4. LOANS. If loans exist between the entities, adequate interest should be charged – if not, the IRS will typically be able to impute interest under Code §§482 and/or 7872. Code §7872 was applied in the subject case. All loans should be documented and treated as such on the books and records – failure to do so could result in deemed distributions and dividends.

On the positive side, the Tax Court had no problem with the concept of a management entity or centralized employer – so long as the parties toe the line on the above issues.

Weekend Warriors Trailers, Inc. v. Comm., TC Memo 2011-105